38 duration zero coupon bond

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.205% yield. 10 Years vs 2 Years bond spread is 459.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.75% (last modification in May 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. Your Money: How duration of a bond determines its degree of price risk Any bond which is traded before maturity, be it a plain vanilla coupon paying bond, or a zero-coupon bond, exposes the holder to price risk. Conservative investors should go for low to moderate...

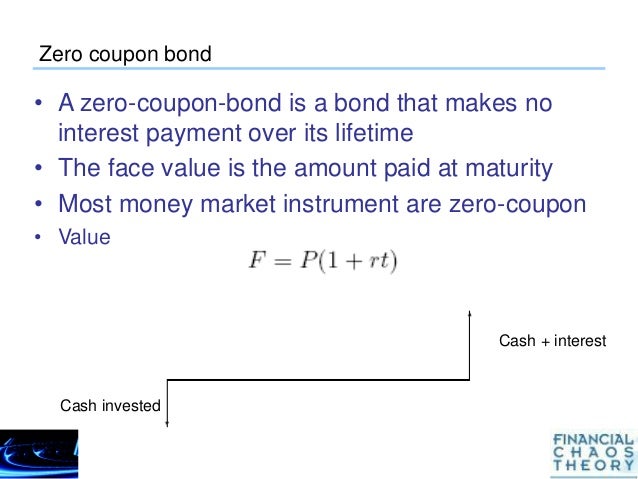

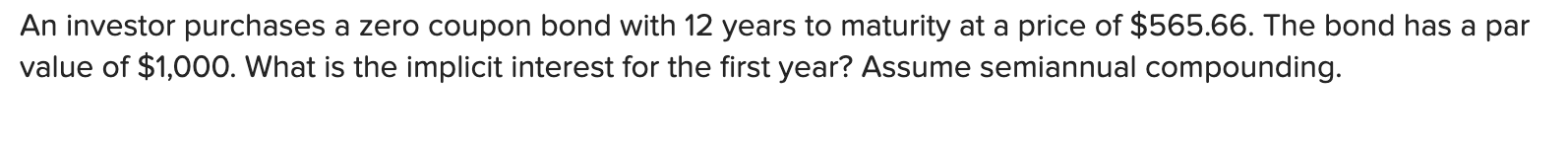

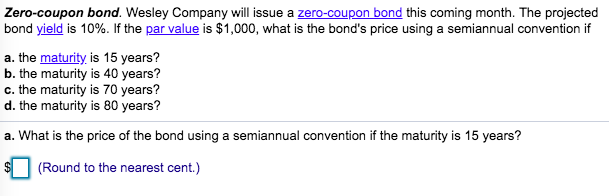

Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Duration zero coupon bond

Bonds- Price, YTM, Duration - BrainMass You have the following set of US Treasury bond data and consultations with your Banks Equity Analyst and Debt Analyst suggest that a Z-spread for Abacus of 200 bps over Treasuries and a coupon rate of 6.5% should be appropriate to attract investors. US Treasury Notes Coupon Yield to Maturity Zero coupon rate 1 Year 3.25% 3% 3% 2 Year 3.80% 3.25% Advantages and Risks of Zero Coupon Treasury Bonds The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index... Consol (bond) - Wikipedia Timeline of 2.5% consolidated stock Final redemption On 31 October 2014 the UK Government announced that it would redeem the 4% consols in full in early 2015. It did so on 1 February 2015, and redeemed the 3 1⁄2 % and 3% bonds between March and May of that year. The final 2 3⁄4 % and 2 1⁄2 % bonds were redeemed on 5 July 2015.

Duration zero coupon bond. Types of Bonds with Durations and Risk Levels - The Balance Key Takeaways. There are five main types of bonds: Treasury, savings, agency, municipal, and corporate. Each type of bond has its own sellers, purposes, buyers, and levels of risk vs. return. If you want to take advantage of bonds, you can also buy securities that are based on bonds, such as bond mutual funds. These are collections of different ... 4 Measuring Interest-Rate Risk: Duration - FIU Faculty Websites A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon ...7 pages Fitted Yield on a 9 Year Zero Coupon Bond (THREEFY9) Graph and download economic data for Fitted Yield on a 9 Year Zero Coupon Bond (THREEFY9) from 1990-01-02 to 2022-05-27 about 9-year, bonds, yield, interest rate, interest, rate, and USA. EDV Vanguard Extended Duration Treasury ETF - SeekingAlpha It primarily invests in extended duration zero coupon U.S. Treasury securities with maturities between 20 and 30 years. ... U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index of extended ...

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund ... Effective Duration As of 06/09/2022 3.25% est. yield to maturity As of 06/10/2022 Fund Facts NAV PRICE $107.56 1 DAY RETURN $-0.29 - As of 06/10/2022 MARKET PRICE $107.83 1 DAY RETURN $0.49 - As of 06/09/2022 PREMIUM / DISCOUNT -0.02% As of 06/10/2022 MEDIAN BID/ASK SPREAD 0.11% As of 06/10/2022 Price Fund Information As of 06/09/2022 Basics Of Bonds - Maturity, Coupons And Yield The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500. › terms › dDuration Definition - Investopedia Nov 11, 2021 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

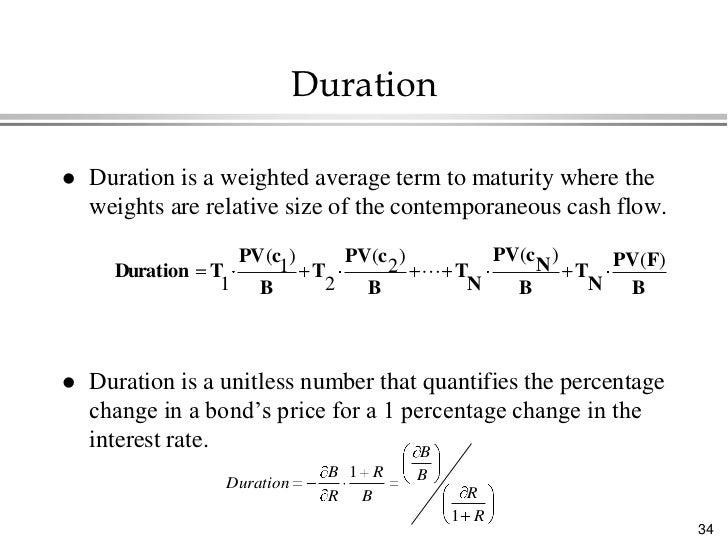

Floating Rate Bonds | Meaning, Funds, ETF, Duration, Maturity - eFM On the other hand duration of a bond is arrived at based on a complicated formula. The essence of calculating duration is to gauge the bond's sensitivity with respect to the changes in the interest rate market. Both duration and maturity are denoted in years. In the case of zero-coupon bonds, the maturity and duration are both the same. groww.in › p › zero-coupon-bondZero-Coupon Bonds : What is Zero Coupon Bond? - Groww There are two types of Zero Coupon Bonds, which are corporate Zero Coupon bonds and Government Zero Coupon bonds. How is the price of Zero Coupon Bond Calculated? The Zero Coupon Fund valuation can be done either on an annual or semi-annual basis. The annually Zero Coupon Bond and the semi-annual Zero Coupon Bond can be measured using two ... Duration - NYU Stern For zero-coupon bonds, there is a simple formula relating the zero price to the zero rate. •We use this price-rate formula to get a formula for dollar duration.17 pages What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount ...12 answers · 16 votes: The duration of a zero coupon bond is the number of years to maturity

What is zero coupon bonds? - myITreturn Help Center Zero coupon bonds may be long or short term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills.

Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

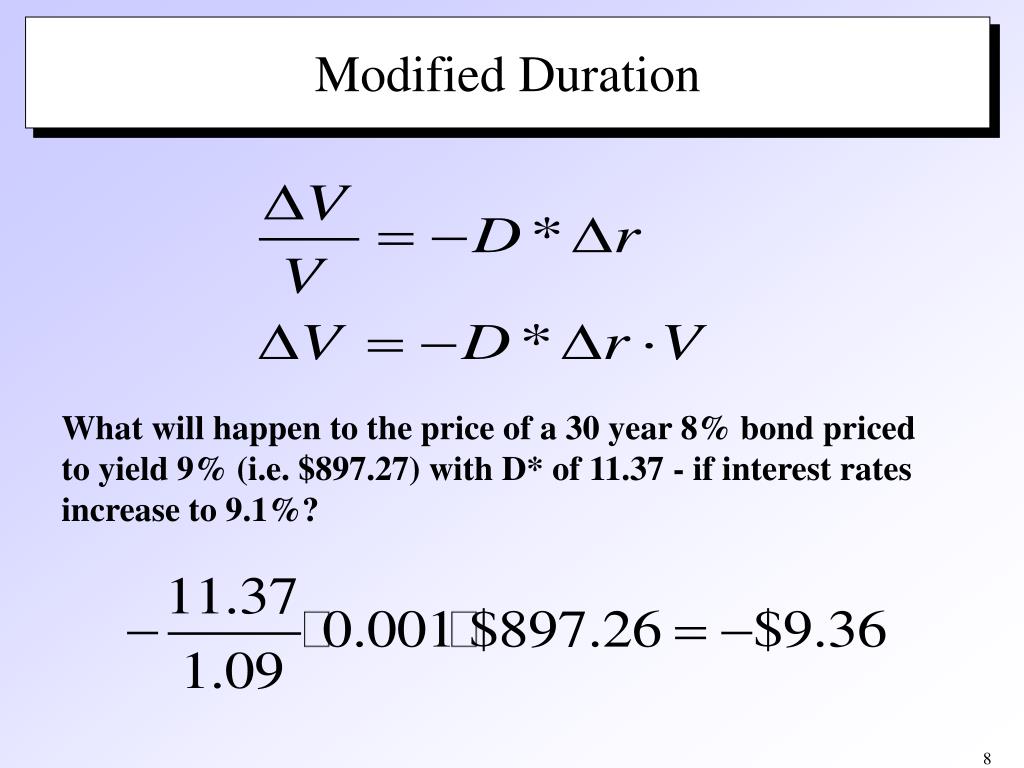

Dollar Duration - Overview, Bond Risks, and Formulas Dollar duration can be applied to any fixed income products, including forwarding contracts, zero-coupon bonds, etc. Therefore, it can also be used to calculate the risk associated with such products. Summary Dollar duration is the measure of the change in the price of a bond for every 100 bps (basis points) of change in interest rates.

Financial Engineering And Interest Rate Derivatives The duration of the zero-coupon bond is unchanged at two years, although its price also increases (to $838.561) when the interest rate falls. a. If the interest rate increases from 9% to 9.05%, the bond price falls from $982.062 to $981.177. The percentage change in price is -0.0901%. b. Using the initial semiannual rate of 4.5%, the duration ...

Stenos Signals #7: Duration is getting killed across all ... - Substack In plain words the duration profile depicts the amount of years until the weighted average of expected cash flows are received by the investor in an asset. That calculation is straight forward for a zero-coupon bond as you simply receive the cash-flow when the bond matures, meaning that a 10yr zero coupon bond has a maturity of 10 years.

What Are Zero Coupon Bonds? - Annuity.com Zero-coupon bonds have a duration equal to the bond's time to maturity, making them sensitive to any changes in the interest rates. In addition, investment banks or dealers may separate coupons from the principal of coupon bonds, known as the residue, so that different investors may receive the principal and each of the coupon payments.

› corporate-finance-tutoringManaging Bond Portfolios: Bond Strategies, Duration, Modified ... The chart also shows that the 5 year zero coupon bond has a modified duration of 4.90, which is greater than the 4.41 modified duration of the 5 year 5% coupon bond. Similarly, the 10 year zero coupon bond has a modified duration of 9.80 compared with a modified duration of 7.92 for the 10 year 5% coupon bond. In both cases, the zero coupon ...

EDV | ETF Portfolio Composition - Fidelity The investment seeks to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index of extended-duration zero-coupon U.S. Treasury securities. The advisor employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index.

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.494% yield.. 10 Years vs 2 Years bond spread is 99.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Understanding Duration | BlackRock

c. Which statement is true for the Macaulay duration of a zero-coupon ... Which statement is true for the Macaulay duration of a zero-coupon bond? The. Macaulay duration of a zero-coupon bond: i. Is equal to the bond's maturity in years. ii. Is equal to one-half the bond's maturity in years. iii. Is equal to the bond's maturity in years divided by its yield to maturity. iv. Cannot be calculated because of the ...

What Is Duration of a Bond? - TheStreet Definition - TheStreet The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is...

Post a Comment for "38 duration zero coupon bond"